Financial analysts have expressed their views towards the Central Bank of Nigeria's suspension of its meeting for the Monetary Policy Rate fixing for two consecutive periods.

Recall that Legit.ng reported that the apex bank failed to hold its monetary policy meeting in September and November, respectively.

The analyst who spoke to Legit.ng said that the new CBN team could be working behind the scenes to repair the transmission mechanism as they buy more time to grasp things fully.

Silence could mean a hold-in stance

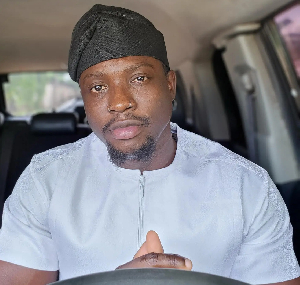

Samuel Oyekanmi, a macroeconomic analyst, opined that not holding the MPC meeting implies that the CBN is maintaining a hold stance.

According to him, this would have been expected if they had the meeting in the first place.

He added that there could have been the understanding that tightening the MPR any further would not have as much impact on inflation as expected due to the underlying factors contributing to the rising prices of goods and services in the country.

He added: Holding the interest rate constant whilst the new dispensation tries to fully understand the system, seems like a promising decision to take, considering that a further hike could hurt the economy, driving the cost of borrowing upward for the real sector, hence, could lead to sluggish growth in the broad economy.

In his view, however, the hold stance is a welcome development. Kaliba Bilala, founder of Tanabit, a financial data analytics company, told BusinessDay that despite several meetings, the MPR has not been effective in taming inflation.

He said: Monetary policy was not effective under past governors, even though they were raising the MPR. The current governor has stayed silent. But he is working behind the scenes to repair the transmission mechanism.

The reason money market interest rates, within the control of monetary policy, have been rising since 25 October 2023.

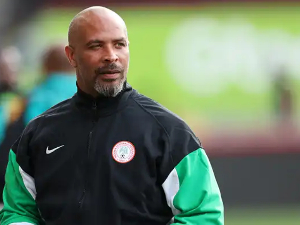

Olumide Adesina, a financial market analyst, hinted at the implication of the decision in the market.

He said: It leaves market participants confused because the CBN of late hasn't talked about the naira’s trading band, when the FX backlogs will be cleared, or when additional liquidity might be added to the market.

Business News of Thursday, 23 November 2023

Source: www.legit.ng