Nigeria Deposit Insurance Corporation (NDIC) said it has invigorated its liquidation activities and greatly increased its debt recovery rate leading to the declaration of 100 per cent liquidation dividends to uninsured depositors of over 20 deposit money banks in-liquidation.

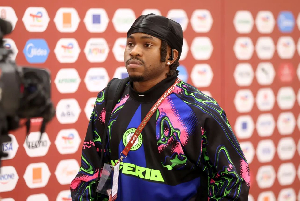

Managing Director/Chief Executive, NDIC, Bello Hassan, stated this at the opening ceremony of the 2023 NDIC Editors Forum held in Lagos at the weekend.

Hassan said the corporation introduced the Single Customer View (SCV) framework that has enhanced the speedy payment of insured sums to depositors of closed banks.

He said NDIC has enhanced collaboration with the bar and bench, leading to speedy prosecution and more informed judgments on failed bank cases. Hassan said this also included the resolution of long-drawn cases of closed banks such as Fortune and Triumph Banks in-liquidation and have as well equally put in place policy and framework for out-of-court settlement, which had enabled the corporation to resolve some hitherto protracted failed bank litigations.

He said in complimenting the consumer protection efforts of the CBN, NDIC has enhanced public awareness of deposit insurance and financial literacy to reduce the rate at which small depositors are being defrauded, thereby enhancing confidence in the banking system.

Hassan said the NDIC’s operations, which focus on minimising bank runs and failures through strict banking supervision, reimbursement of insured depositors in the event of bank failure, and orderly liquidation of failed banks, complements the efforts of the Central Bank of Nigeria (CBN) to achieve a secure and stable banking system.

He said it also supports the fiscal authority in maintaining stability within the broader financial system, serving as the foundation for economic growth and development.

Hassan said the Deposit Insurance System implemented by the NDIC is an important component of the nation’s financial safety net. He said the ultimate objective of the editors’ forum is to facilitate robust collaboration, enhance public awareness, and strengthen public confidence in the Deposit Insurance System in Nigeria, contributing to the overall stability of the nation’s financial system.

Hassan, however, highlighted the adequacy of the deposit insurance coverage, faster reimbursement of depositors in the event of bank failure and the roles of the media in promoting the stability of the financial system amongst others

“Indeed, our vast experience at the forefront of deposit insurance practice in Africa coupled with the Corporation’s resilience in the face of challenges and threats is based on the NDIC’s relentless efforts to achieve its vision to be one of the best deposit insurers in the world.

“The roadmap, robustly outlined in our 2021 – 2025 Strategic Plan takes into consideration the current realities and future trends, as well as sets out targets and objectives to ensure that the Corporation fulfills its mandate by providing excellent and efficient services to our stakeholders across the board,” he stated.

Hassan also highlighted the corporation’s various special recognitions and awards among the comity of Ministries, Departments and Agencies (MDAs) by credible bodies and institutions, which he said serve as compelling evidence of the unwavering commitment of the management and staff to bring about a paradigm shift in fulfilling NDIC’s mandate.

Business News of Monday, 18 December 2023

Source: guardian.ng

NDIC increases debt recovery rate

Entertainment